Your future starts here!

Renew Lending Wholesale

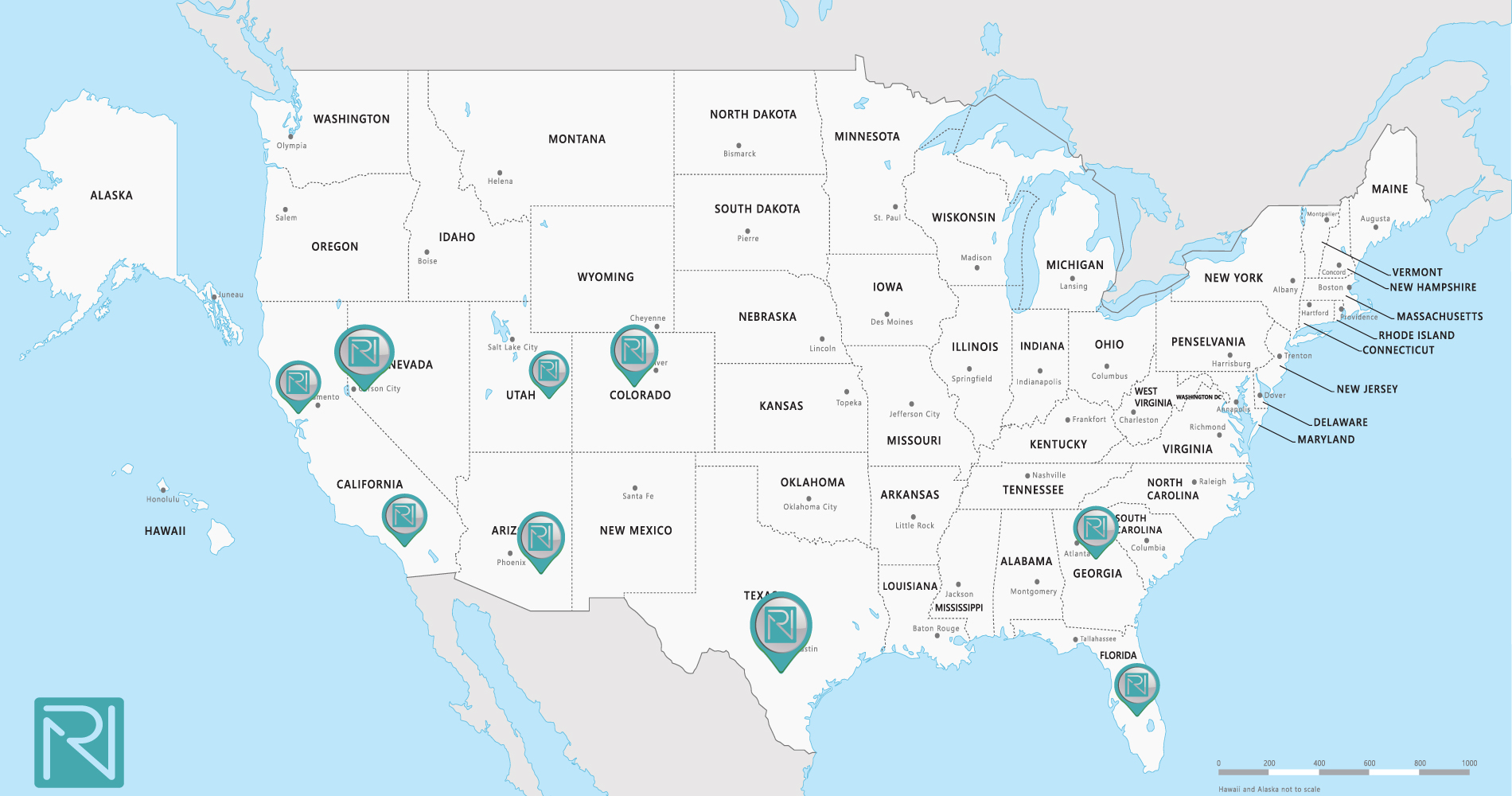

Since 2010, our mortgage team has operated and embodied the principles of Knowledge, Ability and Innovation. We earned a reputation for integrity combined with a high level of trust and communication that sets us apart as a premier mortgage lender serving the TPO community. Our highly experienced executive team and operational staff provide superior customer experiences. Our wholesale lending division works with mortgage brokers and loan originators across several states. Join our team here!

Download ApplicationWho is

ReNew Lending?

ReNew Lending is a leading residential mortgage lender, licensed by the U.S. Department of Housing and Urban Development (HUD), that provides home buyers and our commercial customers mortgages. ReNew Lending was founded with the primary desire to address the needs of customers for faster, easier access to mortgage loans. ReNew has enabled borrowers to obtain mortgages directly from a lender. Providing this “direct” access through “technology” was how “ReNew” was born. With a history of innovation and a commitment to always putting the customer first, ReNew is well positioned to grow even further in its status as a mortgage loan originator of choice. The company’s knowledgeable mortgage professionals are dedicated to making every customer’s home loan experience a positive and successful one.

Why choose

ReNew Lending?

ReNew Lending is built under the principles of honesty and integrity throughout the entire organization. Our mortgage planning specialists are the best in the business. We offer the values and expertise that you deserve and expect in today’s marketplace. ReNew Lending removes obstacles and brings clarity to the lending process. Let us provide you with the best possible service in the industry and a mortgage that you can be proud of.

Schedule MeetingJoining the Team

We know what it’s like to deal with long boarding processes and outdated Broker processes. We have created a process that helps you join the team and move your loans forward. When you join the Renew Lending Team you will be backed by the best Operations group in the buisness.

Step 1) Broker Application

Complete our Broker Application to get started. This application is detailed and we ask that you take your time when completing it.

Download ApplicationStep 2) Submitting Broker Application

Once you are done with the applicaion just complete the Broker Application Submission Form to submit your application. Or you can email everything to wholesale@renewlending.com

Broker Application Submission FormStep 3) Portal Logins

After you have been approved by Renew Lending your accounts will be setup and you will be provided your login info.

Portal LoginRenew Lending Training

Training is a key element to our success. We will teach you to navigate our portal and go over all the features and tools available to you. We will take you through our Loan process from start to finish so you understand our process clearly and introduce you to your support team. Our goal is to ensure you have everything you need to grow your business. After your training you will be all set to start submitting loans!

Portal LoginLoan Submission Process

Our easy loan submission process has been a game changer. Our portal connects you with our Operations team and gives you all the tools you need to succeed.

1

Quick Pricer

Our Portal has a Quick Pricer that lets you check pricing and then you can easily convert to a lead file. Then your lead can be converted to loan. You can also import the lead/loan and then price it.

2

Loan Setup

Your Processor will need to follow our submission checklist to make sure the loan is ready for disclosures. Once the checklist is completed the loan is ready for disclosures!

Submission Checklist3

Loan Disclosures

Once your processor has the loan setup it is time to complete the Loan Disclosure Submission Form. This form tells our Disclosure desk that your loan is ready. It asks all the important questions to make sure your borrower is sent accurate disclosures.

Disclosure Submission Form4

Order Appraisal

After the loan disclosures are signed by the borrower(s) you can now order the appraisal. You will use your own trusted AMC. Then you just list Renew Lending as the Lender.

Order Appraisal5

Underwriting Conditions

Our Portal gives you a customizable Pipeline view. You can track your loans and conditions. When you are inside a loan you will see the list of conditions. you will also receive email notifictions and Approval letters that break down the conditions needed. Underwriting support is always available.

6

Clear To Close

Once you have the full approval from Underwriting your loan will move to Clear To Close. Our Closing team will make sure the loan is ready for Docs Out. You will need to complete the CD Doc request form at this point.

Closing Disclosure Request7

Docs Out

The closing department will send the closing documents to Escrow and make sure signing is scheduled.

8

Docs Back

The closing department will review the signed document package and get the file ready for Funding.

9

Funding!

The Funding department will handle the funding conditions and get the loan finished up. Your loan is now completed!

Loan Programs

ReNew Lending offers a wide range of Loan Programs to help in all different situations.

From first-time homebuyers to Investment Properties, Renew has it all!

Conventional

Conventional loans are good for everyone from first time home owners to real estate investors looking at rental properties.

– FICO credit score of at least 620

– DTI ratio of 43% (up to 49% in some cases)

– As low as 3% down payment, LTV < 97%

– Primary/Second Home/Investment residency w/ most property types allowed

FHA

FHA loans generally require a lower minimum down payment and lower credit scores than many conventional loans.

– FICO credit score of 580 or higher

– DTI ratio of 43% (up to 45%-50% in some cases)

– At least 3.5% down payment, LTV < 96.5%

– Primary occupancy only w/ most property types allowed

VA

VA loans require no down payment and are a great option for military veterans, active duty, & all qualified servicemembers.

– FICO credit score of 580 or higher

– DTI ratio < 55%

– No down payment, LTV < 100%

– Primary occupancy only w/ most property types allowed

Renew Lending Lender Fee Breakdown

Conventional Loans

$995

Lender Fee Breakdown

- Underwriting Fee

- Doc Prep Fee

- Appraisal Review

Schedule a Meeting to get the answers you need.

Schedule MeetingBenefits of Joining

ReNew Lending offers all the advantages of working for a large lender and combines them with the freedom and flexibility that you would expect from a smaller company. ReNew gives you access to expert in-house operations, support, and marketing teams to help with lead generation and ensure the mortgage process keeps moving efficiently for every client.

Supportive Team

We offer expert support for every level of the mortgage process, from lead generation and IT support, to underwriting, processing, and closing.

Real-time Status Updates

Our operations team will provide you with real-time status updates. You won’t find this type of personal attention and support at a large lender or bank.

Competitive Loan Products

ReNew works with multiple investors and sells directly to agencies to provide our loan officers a variety of mortgage and refinance products at competitive rates. We also offer many local and state specific programs.

Read Our Reviews!

Don’t take our word for it – here’s what our clients say:

I am happy to say that working with Renew Lending was an awesome experience in buying our new home. The process went smooth and answered all of our questions buying a house is difficult enough but working with the team at Renew Lending just made it so much easier. Thank you again team at Renew Lending! Thumbs up !!!

Maria Sanchez

Renew Lending and team were amazing. They were able to rush through the whole process in record time. Doing everything online made the experience really easy. It’s a very streamlined system. Much better than working with a bank which priorities might be elsewhere. Renew Lending is specialized so it makes the process really easy. All automated, upload materials on the system and get a very personalized experience. I totally recommend Renew Lending and will keep using them for future purchases and refinances.

Joe Neuah

Renew Lending is undoubtedly the most professional and efficient lender I’ve ever worked with. He sees bumps on the road long before you get there, and is able to handle anything that arises with professionalism and tact. My clients and I appreciate his hard work and dedication. His attention to detail is superb. Loans can be quite daunting and scary but with Renew Lending on our side, every deal is a great success! Thank you Renew Lending for always treating my clients and I as if we are the only client you have. You’re the best!

Libby Brown

Join us! It will only take a minute

Contact Us

Josh Munns

Phone: 775-233-7350

Email: josh.munns@Renewlending.com

Fax: 775-201-9198